Top Guidelines Of Amur Capital Management Corporation

Top Guidelines Of Amur Capital Management Corporation

Blog Article

Not known Factual Statements About Amur Capital Management Corporation

Table of ContentsSome Known Questions About Amur Capital Management Corporation.Everything about Amur Capital Management CorporationFascination About Amur Capital Management CorporationSome Known Details About Amur Capital Management Corporation Fascination About Amur Capital Management CorporationSome Known Details About Amur Capital Management Corporation The Buzz on Amur Capital Management Corporation

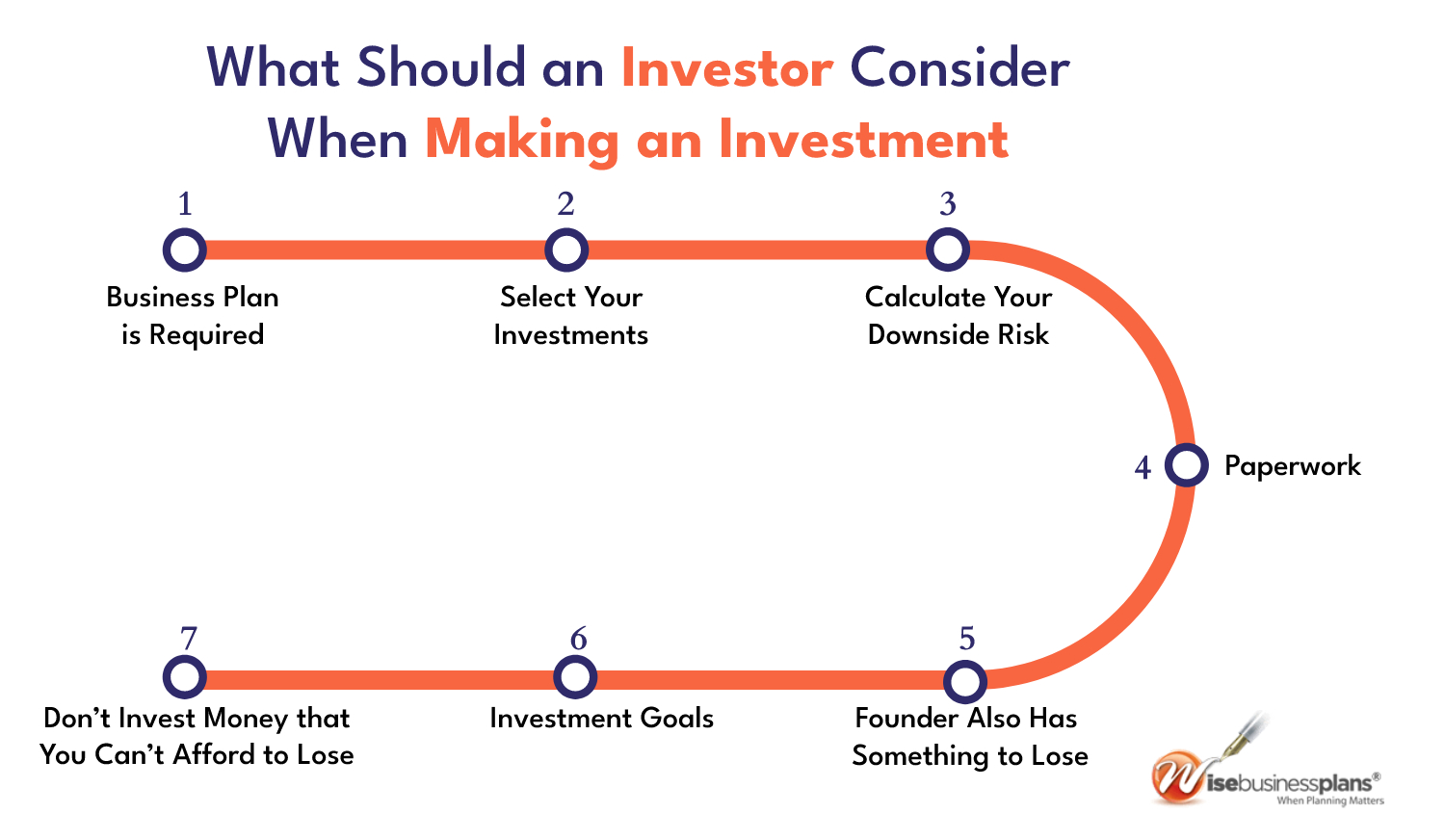

A reduced P/E proportion might indicate that a company is undervalued, or that financiers expect the company to deal with much more difficult times ahead. Capitalists can utilize the ordinary P/E ratio of other firms in the exact same industry to create a standard.

Amur Capital Management Corporation Can Be Fun For Anyone

A stock's P/E proportion is very easy to find on a lot of financial coverage websites. This number suggests the volatility of a supply in contrast to the market as a whole.

A supply with a beta of over 1 is in theory more volatile than the marketplace. For instance, a security with a beta of 1.3 is 30% more unstable than the market. If the S&P 500 increases 5%, a supply with a beta of 1. https://calendly.com/christopherbaker10524/30min.3 can be anticipated to rise by 8%

Getting The Amur Capital Management Corporation To Work

EPS is a dollar number standing for the part of a firm's revenues, after tax obligations and participating preferred stock returns, that is assigned per share of ordinary shares. Financiers can utilize this number to assess how well a firm can deliver worth to shareholders. A higher EPS results in higher share costs.

If a firm routinely falls short to deliver on earnings projections, a financier may desire to reconsider buying the stock - alternative investment. The computation is simple. If a business has an internet income of $40 million and pays $4 million in rewards, then the staying sum of $36 million is split by the variety of shares exceptional

Everything about Amur Capital Management Corporation

Financiers commonly get interested in a stock after reading headings concerning its phenomenal efficiency. An appearance at the trend in costs over the previous 52 weeks at the least is needed to get a feeling of where a supply's price might go next.

Allow's consider what these terms indicate, exactly how they differ and which one is ideal for the typical investor. Technical experts comb with huge quantities of information in an initiative to forecast the instructions of supply rates. The data is composed primarily of past rates information and trading quantity. Essential evaluation fits the needs of the majority of financiers and has the benefit of making excellent feeling in the real globe.

They think costs comply with a pattern, and if they can understand the pattern they can maximize it with well-timed trades. In current years, innovation has made it possible for more capitalists to practice this design of investing since the devices and the data are a lot more obtainable than ever before. Basic analysts think about the intrinsic worth of a supply.

Amur Capital Management Corporation - Questions

Technical analysis is best suited to someone that has Full Report the time and comfort degree with data to put limitless numbers to utilize. Over a duration of 20 years, annual fees of 0.50% on a $100,000 financial investment will lower the profile's value by $10,000. Over the exact same duration, a 1% charge will certainly minimize the very same profile by $30,000.

The trend is with you. Lots of common fund companies and on the internet brokers are decreasing their charges in order to complete for clients. Benefit from the pattern and search for the most affordable cost.

The 6-Second Trick For Amur Capital Management Corporation

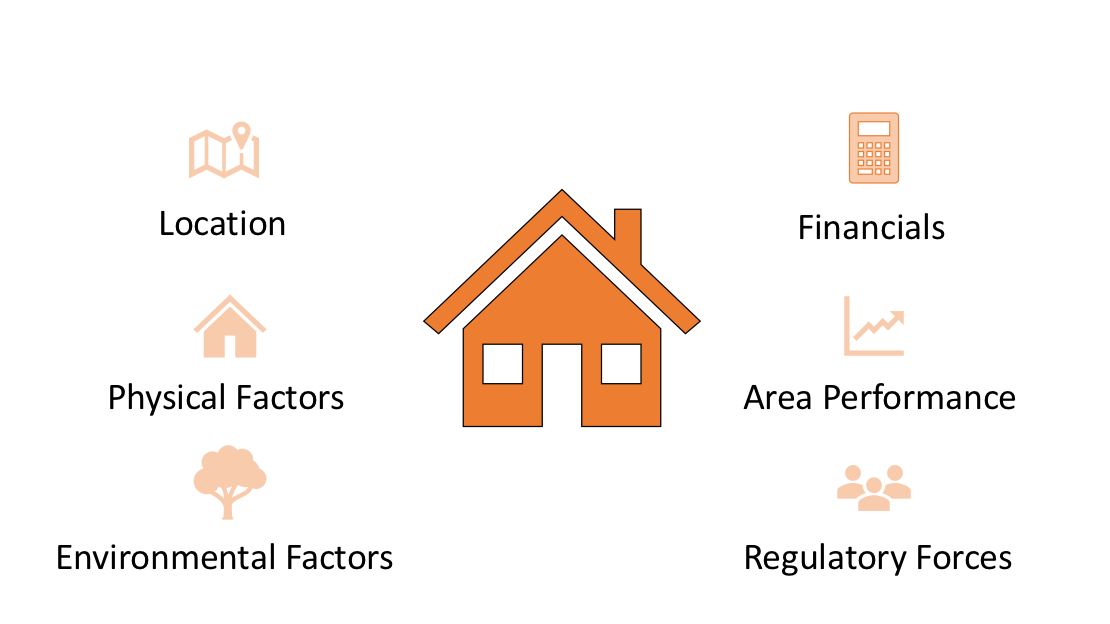

Closeness to features, eco-friendly space, panoramas, and the community's condition element plainly into house appraisals. Closeness to markets, storage facilities, transport centers, freeways, and tax-exempt locations play an essential duty in industrial residential or commercial property evaluations. A crucial when considering property place is the mid-to-long-term sight pertaining to exactly how the location is expected to evolve over the financial investment period.

6 Easy Facts About Amur Capital Management Corporation Described

Thoroughly review the ownership and designated use of the prompt areas where you prepare to spend. One way to collect info about the potential customers of the location of the building you are considering is to call the city center or various other public firms accountable of zoning and metropolitan planning.

Building valuation is essential for financing during the purchase, noting cost, financial investment evaluation, insurance policy, and taxationthey all rely on realty appraisal. Typically utilized genuine estate valuation approaches include: Sales contrast technique: recent equivalent sales of properties with similar characteristicsmost common and suitable for both new and old residential properties Expense strategy: the price of the land and building and construction, minus devaluation suitable for brand-new building and construction Income technique: based on expected cash money inflowssuitable for services Offered the low liquidity and high-value financial investment in property, an absence of clearness deliberately may result in unanticipated results, consisting of financial distressparticularly if the investment is mortgaged. This offers normal income and long-lasting value recognition. This is typically for fast, tiny to medium profitthe typical property is under building and sold at a revenue on conclusion.

Report this page